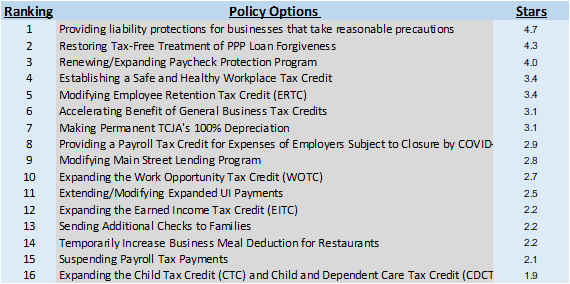

CIRT joined with a cross-section of business associations and organizations in a survey identifying the groups top priorities for the next COVID-19 response bill. The survey asked trade groups to rank sixteen policies on a five-star scale along the following lines (with a score of 3 being essentially the mid-point):

The polices listed in the survey are largely limited to those directly affecting businesses and the workers they employ. These policies were included in the House-passed HEROES Act, the proposed Senate Republican Phase IV bill, and the Administration’s stated priorities. They lean primarily to tax policy, but not entirely.

Sixty-two organizations responded, providing what appears to be well-rounded answer to the critical question of what’s important to employers as Congress continues to grapple with COVID-19; see results below.

The top priority from the survey is for Congress to “provide employers with liability protection” if they reopen their businesses while taking reasonable precautions to protect their employees. This policy scored an almost perfect 4.7, suggesting that the business community has shifted its focus from helping employers and workers during the shutdown to taking the steps necessary to reopen the economy.

The other policies that scored 4 or better focused on the Paycheck Protection Program. Of the myriad of policies enacted to respond to the COVID-19 shutdown, no program has been as widely utilized as the Paycheck Protection Program (PPP). Despite several missteps, the program provided more than $500 billion in needed capital to over five million businesses.

For the next COVID-19 bill, the business trade strongly support restoring the tax deductibility of PPP loan forgiveness. This was clearly Congresses’ intent when it enacted the program, and its simply inexplicable that the Treasury Department continues to oppose this policy in the current environment. Business trades also support extending the PPP program’s authorization and making its benefits more accessible.